Landlords

We are a family run property management

company specialising in lettings since 1996.

Our aim is to find professional and quality

tenants for your property.

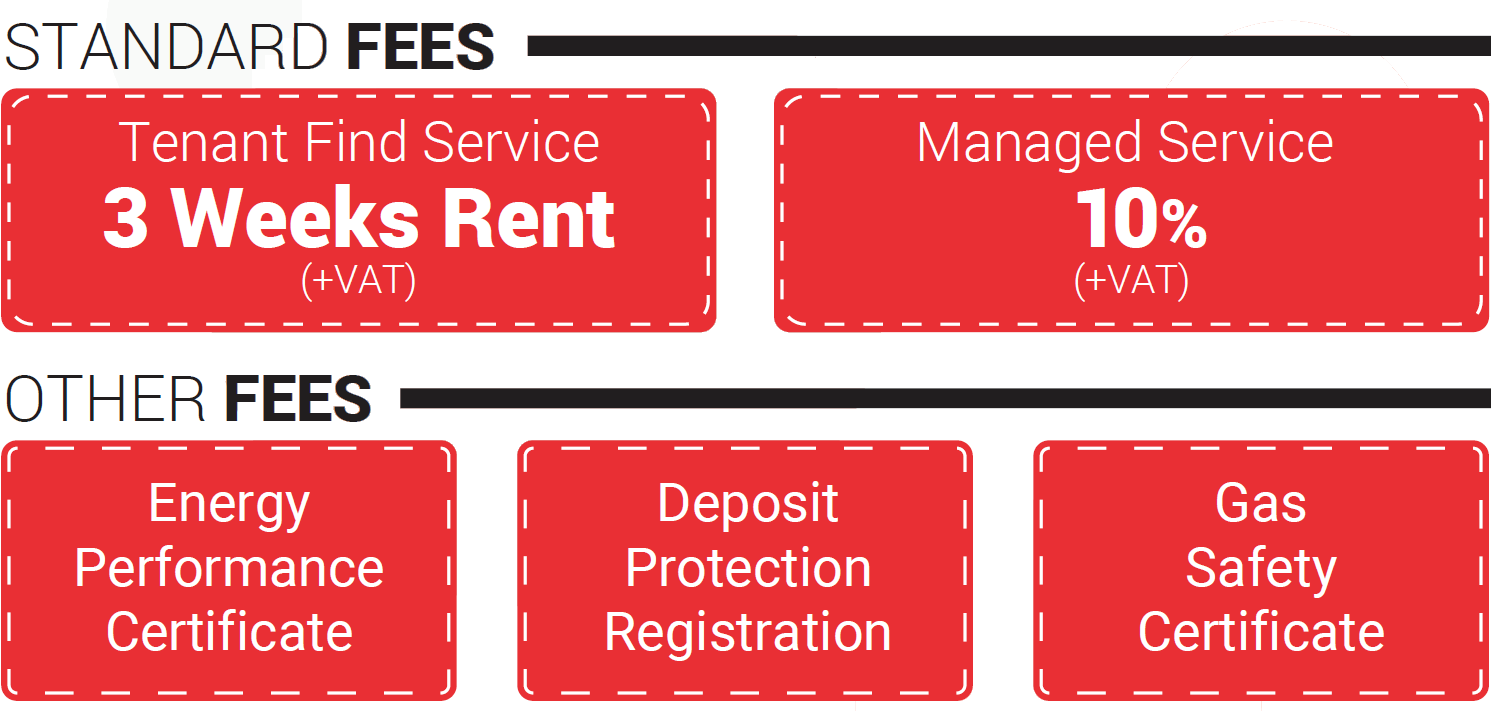

The Market Place offers a comprehensive management or tenant find service which is outlined below:

| Services |

Tenant Find Service |

Managed Service |

| Marketing to find a suitable tenant |

Tenant Find |

Managed |

| Obtaining tenant credit checks, referencing & identity |

Tenant Find |

Managed |

| Preparation of tenancy agreement |

Tenant Find |

Managed |

| Full inventory including pictures |

Tenant Find |

Managed |

| Collection of first rental payment |

Tenant Find |

Managed |

| Transfer of utilities |

Tenant Find |

Managed |

| Lodging of deposit |

Tenant Find - Further Fee |

Managed |

| Rental collection |

Tenant Find |

Managed |

| Arranging of quotes, repairs & maintenance |

Tenant Find |

Managed |

| Access to vetted contractors |

Tenant Find |

Managed |

| Property inspections |

Tenant Find |

Managed |

| Manage check out process |

Tenant Find |

Managed |

| Deposit negotiation & submission |

Tenant Find |

Managed |

PROPERTY MANAGEMENT

Tenants expect a service in return for the rent they pay and prefer a property to be managed by a

professional. Offering 20+ years of experience, our staff are on hand to help. We have become a

market leader in terms of lets agreed and much of our business comes from recommendations. We

currently manage hundreds of properties on a daily basis so let the experts manage your property.

CLIENT MONEY PROTECTION & CODES OF PRACTICE

The Market place is a member of the national approved letting scheme, the property ombudsman

scheme and is registered as a safe agent. Being a member of these industry bodies insures landlords

and tenants the highest level of service.

SAFETY

Gas safety certificate

In accordance with the gas safety regulations 1998, every gas appliance and all gas pipework will need

to be certified as safe by a certified gas safe engineer. Inspections must be completed before move in

and be carried out annually thereafter.

SMOKE ALARMS

Any property built after 1992 should be fitted with mains operated smoke detectors and alarms on

each floor under building regulations. It is now a legal requirement to install a smoke alarm on every

floor of a rental property. The inventory will record whether smoke alarms are present on move in.

CARBON MONOXIDE ALARMS

A carbon monoxide alarm must be installed in any room with a solid fuel installation (E.G. wood

burning stove). This should also be tested to ensure they are in good working order at the start of every

tenancy.

ELECTRICAL SAFETY

The electrical equipment regulations 1994 state that anything electrical within the property, or anything

that you supply as part the fixtures and fittings should be up to current electrical safety standards and

safe to use.

FURNITURE & FURNISHINGS

Furniture manufactured today must have a safety label stating it meets the furniture and furnishings

(fire) (safety) regulations 1988. It is a good idea to check that sofas, beds, bedheads, cushions, pillows

and furniture covers still have the relevant safety tag attached. Furniture manufactured prior to 1950

is exempt but it is best practice to remove vintage, antique or sentimental items from your property.

YOUR LEGAL REQUIREMENTS

ENERGY PERFORMANCE CERTIFICATE (EPC)

It is a legal requirement to have a valid EPC when marketing your property and a copy must be made

available to prospective tenants free of charge. The Market Place can arrange this for you and they are

valid for up to ten years. From the 1st of April 2018, all rented properties must have a minimum energy

performance rating of E or above.

CONSENT TO LET

Please remember to obtain permission to rent

the property from any co-owners(s) as well as

permission from any mortgage provider or

freeholder, if applicable. Ensure all property

owners are named as "the landlord" on the

lettings paperwork.

TAX ON RENTAL INCOME

All rental income arising from property in the UK

is subject to tax. UK residents can usually

complete a HMRC self-assessment tax return to

declare this income. Overseas landlords have to

be taxed at source. We recommend taking

professional tax advice to ensure you are

maximizing your allowances.

INSURANCE

As a landlord you must have buildings and

contents insurance in place at all times and

these should be specific to a rental property.

Even if your property is not furnished, it is still

worth considering having contents insurance as

some offer public liability cover, replacement

locks and potentially the cost of rehousing

tenants in the event of a fire or flood.

Unfurnished properties that contain white goods

such as a washing machine or fridge are still

worth insuring under a policy specific to a rental

property since the cost of repair/replacement

can be considerable.

LANDLORD FEES, CONTRACT

CONTRACTS

A tenancy agreement is the contract between a

landlord and tenant. Our reviewed agreement

has a direct impact on your ability to make a

claim on the tenant’s deposit and hold them

liable for rent. We will customise the contract

based on your requirements and requests.

DEPOSITS

The deposit is usually equivalent to one month’s

rent but this can be altered to your requirements.

We are legally required to register a deposit for

an assured shorthold tenancy every time a

tenancy agreement is signed. Failure to do so

entitles the tenant to make a claim against the

landlord and the penalty for non-compliance is

up to three times the deposit value. Landlords

and letting agents who take a deposit in England

must protect it within 30 days of receiving the

money from the tenant.

AT THE START OF THE TENANCY

CLEANING, INVENTORY & CHECK IN

Tenants expect a property to be professionally cleaned at the outset, therefore this requires the tenant

to return the property cleaned to the same standard at the end of the tenancy. An inventory will serve

as a record of the condition of the property at the outset and will be used to re-asses the condition at

the end of the tenancy. Wear and tear is to be expected during the course of the tenancy. The inventory

also records meter readings (when accessible).

UTILITY ACCOUNT

It is normally the tenant’s responsibility to pay

utilities, council tax and TV licence. However,

you can adjust these if you want to include some

bills in the monthly rental amount. Utilities are

separate to ground rent, service charges,

buildings and contents insurance which remain

the landlord’s responsibility to pay.

Tenants are entitled to change utility supplier

during their tenancy.

AT THE END OF THE TENANCY

CHECK-OUT

The check-out inspection should consist of high quality photos and a detailed room by room

description of the condition of the property. This dated report will be evidence of the cleanliness of the

property at the end of the tenancy which is critical if a landlord subsequently makes a claim against the

tenant’s deposit.

DEPOSIT DEDUCTIONS

At the end of the tenancy the tenant is required to request the return of the deposit. The landlord must

inform the tenant of any proposed deductions. If there is a dispute on proposed deductions, then the

amount in dispute is transferred to the deposit scheme being used and their alternative dispute

resolution service will determine the outcome. This is an evidence based process decided by an

impartial qualified adjudicator. Remember that wear and tear will occur especially if a tenant has been

in occupation for a number of years. A landlord must also inform the tenant of any proposed

deductions for dilapidations and damages, but cannot claim for betterment. Landlords cannot use the

tenants deposit as a redecorating budget to improve the property condition, only to restore it to the

same condition as the start of the tenancy, save for fair wear and tear. Discussing deposit deductions

can be the most difficult part of being a landlord. Clients using our managed service benefit from The

Market Place conducting all deposit negotiations and evidence submissions on their behalf in the

event of a dispute.